Meeting Financial Needs with Speed and Simplicity

In today’s fast-moving world, unplanned expenses can arise at any time. Whether it’s an emergency medical bill, unexpected travel, or a temporary cash crunch, quick access to funds becomes essential. This is where an online loan becomes a practical solution. With the growing use of smartphones and digital platforms, applying for a loan is now easier than ever through a personal loan app.

Instead of visiting a physical bank, waiting in queues, and submitting heaps of paperwork, one can now secure a personal loan within minutes. The digital transformation of lending services allows individuals to handle financial gaps without delay. This will walk you through the advantages, features, and steps involved in using an online personal loan app effectively.

Understanding Online Personal Loans

What Is an Online Personal Loan?

An online personal loan is an unsecured loan offered via digital platforms. These loans do not require any collateral and are designed to meet a wide range of financial needs. Whether it’s household expenses, utility bills, or educational costs, users can rely on this flexible funding option.

Unlike traditional banking methods, these loans are disbursed quickly, often within a few hours of approval. The entire process, from application to disbursal, happens online through a personal loan app or web-based platform.

Who Can Apply for It?

Most online personal loan platforms cater to salaried individuals, self-employed professionals, and even freelancers. The eligibility criteria generally include a stable income source, a valid identification proof, and a working bank account.

Some platforms may also require a basic credit history. However, many apps are now becoming inclusive by offering services even to individuals with limited or no credit background.

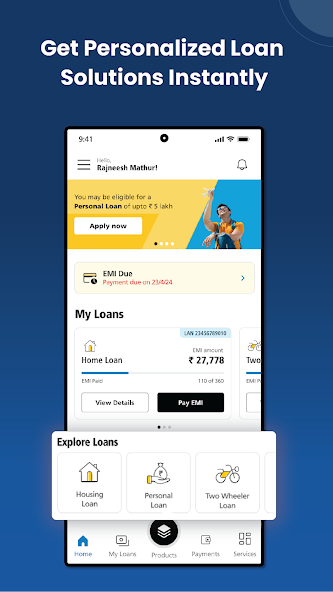

Key Features of a Personal Loan App

Quick Approval and Disbursal

One of the standout features of using a personal loan app is speed. After submitting the basic documents and completing the digital verification, users can often receive loan approval within minutes. The approved amount is usually credited directly to the user’s bank account.

Easy Documentation

Applying through an online loan app means less paperwork. Typically, the required documents include proof of identity, proof of address, income statement, and bank details. All uploads are done digitally, eliminating the need for physical submission.

24/7 Accessibility

A major benefit of online personal loan apps is that they are available round the clock. There’s no need to align with bank working hours. Whether it’s early morning or midnight, users can apply for a loan anytime, anywhere.

Customizable Loan Amounts and Tenure

Most personal loan apps allow users to choose a loan amount as per their needs, typically ranging from a few thousand to a few lakhs. Users can also pick a repayment period based on their comfort, ranging from a few weeks to several months.

Real-Time Loan Status Updates

These apps provide transparent tracking of your application status. Users can log in and check whether their loan is approved, disbursed, or under review. This keeps the borrower informed throughout the process.

Benefits of Using an Online Loan Platform

No Physical Visits

Everything is digital, from application to disbursal. Users don’t need to take time off work or travel to a financial institution.

Instant Communication

Most apps include chat support, email assistance, or call options for users to get help instantly during the application or repayment phase.

Secure Transactions

Data encryption and secure login features make sure your personal and financial details remain safe. Leading platforms comply with financial data protection guidelines.

Multiple Use Cases

The funds can be used for a range of urgent needs—be it a health emergency, school fees, travel costs, or home repairs. There are no restrictions on how the borrowed amount is spent.

Step-by-Step Process to Apply Using a Personal Loan App

Step 1 – Download the App

Start by downloading a trusted online personal loan app from your device’s app store.

Step 2 – Register and Fill In Details

Create an account by providing your basic details like name, email, and phone number. Then complete the application form with accurate financial information.

Step 3 – Upload Documents

Digitally upload documents such as PAN card, Aadhaar card, income proof, and bank statements. Ensure they are clear and readable to avoid delays.

tep 4 – Wait for Verification

Once your documents are uploaded, the app verifies your information. This process is usually automated and takes a few minutes to a few hours.

Step 5 – Receive Approval and Funds

Upon successful verification, the loan is approved and the amount is transferred directly to your bank account. Users are notified through SMS or in-app messages.

Responsible Borrowing Tips

Even though getting an online loan is quick and easy, borrowers should be careful and responsible. Only borrow what is necessary and ensure that you can repay the amount on time. Timely repayment helps build a good credit history and keeps financial stress away.

Check for hidden charges, processing fees, and prepayment clauses before accepting the loan terms. Being aware of all conditions ensures transparency and helps in better financial planning.

Conclusion: A Practical Solution for Urgent Needs

When faced with urgent financial requirements, turning to a personal loan app can be a practical and efficient option. With features like fast disbursal, minimal documentation, and anytime accessibility, it eliminates the traditional delays and hassles.

The digital convenience of an online loan ensures that users can access funds from the comfort of their home, whenever the need arises. Whether it’s for a sudden expense or a temporary financial shortfall, these apps make borrowing straightforward and reliable.

In today’s fast-paced world, the availability of a user-friendly online loan system through a personal loan app is a much-needed financial tool for modern individuals. Use it wisely and it can be a lifeline during urgent money needs.