In today’s financial landscape, managing investments efficiently begins with the decision to open a demat account. A demat account, short for dematerialized account, is essential for holding securities such as stocks, bonds, and exchange-traded funds in electronic form. With the increasing shift towards digital investment platforms, more individuals are seeking to open demat account options that come with no charges. A free demat account allows investors, particularly beginners, to enter the market without incurring maintenance or setup fees. This explores the concept, features, and benefits of a free demat account while offering guidance on how to use one for effective investing.

What is a Demat Account?

A demat account serves as a digital vault where investors store their securities electronically. It replaces physical share certificates, making transactions faster, safer, and more organized. All buying and selling of shares on stock exchanges are conducted through a demat account. It interacts with a trading account and a linked bank account to complete investment transactions seamlessly.

This digitized approach eliminates risks associated with physical certificates, such as damage, theft, or misplacement. It also helps investors track their portfolio in real-time with the assistance of user dashboards and statements.

Why Choose a Free Demat Account?

No Opening Charges

Traditional demat accounts often come with charges related to account setup, annual maintenance, and other fees. A free demat account removes such cost barriers, allowing investors to begin their journey without upfront financial commitments.

Suitable for First-Time Investors

Many new investors hesitate to participate in stock markets due to the perceived complexity and associated costs. A free demat account provides a low-risk entry point, making it suitable for those who want to start investing in a controlled and cost-efficient manner.

Long-Term Cost Savings

Over time, eliminating recurring charges such as annual maintenance fees can result in noticeable savings. For investors with modest or long-term portfolios, this structure reduces the overall cost of holding securities.

Features of a Free Demat Account

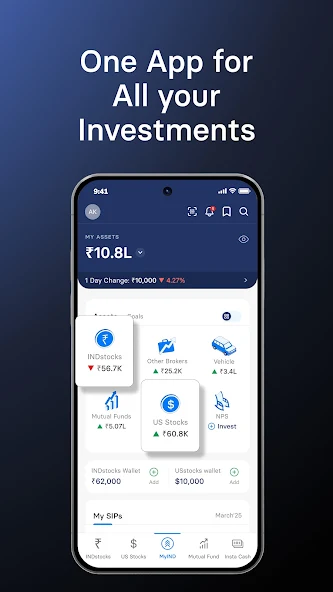

Digital Accessibility

Users can access their account anytime through mobile apps or web portals. This allows for quick monitoring of investments, portfolio performance, and real-time updates on securities.

Integration with Trading Platforms

While the demat account stores securities, it is usually linked to a trading platform that facilitates buying and selling. This integration ensures that transactions are smooth and well-recorded.

Secure Recordkeeping

Electronic records prevent manual errors and provide a reliable source of transaction history, holdings, and dividend information. Security protocols safeguard sensitive financial data from unauthorized access.

User-Friendly Interface

Free demat accounts are typically designed to be intuitive. Investors can easily navigate through account details, investment options, and statement downloads without advanced technical skills.

Steps to Open a Demat Account

- Complete Online Registration

Visit the selected financial platform’s website and fill out the registration form with basic personal and financial details. - Submit Documents Digitally

Upload scanned copies of identification proof, address proof, and a bank account statement or cancelled cheque. Most processes now accept Aadhaar-based eKYC verification for faster approvals. - eSign and Verification

Review the application and digitally sign the documents. An authorized representative may perform an online verification via video or phone. - Account Activation

Once verified, login credentials are sent via email or SMS. The demat account is then ready for use, typically within 24 to 48 hours.

How to Use a Demat Account Efficiently

Monitor Your Portfolio Regularly

Keeping track of your holdings ensures that you remain updated on market performance and potential rebalancing needs. Periodic checks help investors make informed decisions.

Link with a Trading Account

Linking your demat account to a trading platform is essential for buying and selling securities. It ensures that trades reflect in your demat holdings automatically.

Maintain Updated Contact Information

Ensure your email, mobile number, and bank details are always current to avoid missing crucial alerts, dividend credits, or other updates.

Avoid Dormancy

Inactive accounts may be flagged or subject to closure depending on service provider policies. Even a small transaction occasionally keeps the account active.

Who Should Consider a Free Demat Account?

- New Investors: Looking to understand market dynamics without financial commitment.

- Students and Young Professionals: Seeking to invest small amounts without recurring charges.

- Long-Term Holders: Who plan to invest and hold for years with minimal account activity.

- Cost-Conscious Individuals: Who want to maximize returns by reducing account maintenance costs.

Risks and Considerations

Though free demat accounts remove initial costs, investors must remain aware of any potential hidden charges for trading, SMS alerts, or value-added services. Reading the account terms carefully before proceeding is essential.

Additionally, always ensure that the service provider is registered with the appropriate regulatory bodies and follows compliance measures for investor protection.

The Growing Role of Demat Accounts in Investment

With markets becoming more accessible to retail investors, having a demat account is no longer optional. Whether investing in equities, mutual funds, bonds, or exchange-traded funds, a demat account plays a central role in transaction execution and recordkeeping.

As financial literacy spreads and digital tools improve, more individuals are moving away from traditional investment models. The convenience and low-cost nature of demat account options, especially those with no opening or annual fees, contribute significantly to this shift.

Conclusion

Choosing to open a demat account with zero charges is a practical step toward entering the investment world with minimal risk. A demat account not only facilitates secure and convenient handling of securities but also promotes disciplined investing. Free demat account offerings allow individuals to explore the stock market without the burden of fees, making financial growth more accessible to all.

Whether you’re beginning your investment journey or looking to simplify the way you manage securities, a free demat account is a valuable tool that aligns with modern financial needs. Make informed choices, understand the features, and take advantage of this cost-effective option to build a stronger investment future.