The Indian financial market has undergone significant transformation with the rise of digital platforms. A major part of this change is the increasing accessibility of Demat accounts through Indian stock trading apps. Whether you’re just beginning to explore the stock market or aiming to manage your investments more efficiently, creating a Demat accountIndian Stock Trading App is your first essential step. In this guide, you will learn how to set up your Demat account in minutes, why it’s important, and how Indian stock trading apps simplify the process.

A Demat account holds your shares and securities in electronic form, eliminating the need for physical share certificates. This digital approach not only ensures safety but also offers convenience in tracking your investments. The popularity of Indian stock trading apps has made it simpler than ever to manage a portfolio from a smartphone. If you’re new to investing or looking to transition from traditional trading methods, this is designed to walk you through the essentials of starting out.

What Is a Demat Account?

A Demat account, short for dematerialized account, enables investors to store financial securities such as stocks, mutual funds, and bonds in electronic format. Instead of handling paper-based certificates, all transactions and holdings are managed digitally, offering a secure and fast method to invest in the stock market.

The structure of a Demat account is similar to a bank account. However, instead of storing money, it stores securities. With the help of an Indian stock trading app, you can monitor real-time market movements, execute trades, and keep a tab on your portfolio—all from your phone or computer.

Why Do You Need a Demat Account?

Having a Demat account is mandatory for anyone who wants to trade in the Indian stock market. Here are the key benefits:

- Ease of Access: With Indian stock trading apps, your Demat account is accessible 24/7.

- Faster Transactions: Buying and selling shares becomes almost instantaneous.

- Secure Storage: Eliminates risks associated with physical documents such as loss or forgery.

- Consolidated View: View all your holdings and transactions in one place.

It’s also worth noting that without a Demat account, you cannot trade in listed securities in India, as all transactions must be conducted electronically.

Documents Required to Open a Demat Account

Opening a Demat account is a streamlined process when using an Indian stock trading app. To get started, ensure you have the following documents ready:

- PAN card

- Aadhaar card

- A passport-size photo

- A canceled cheque or recent bank statement

- Signature on a white paper

Most platforms will allow you to complete the entire verification process online via digital KYC, reducing the need for paperwork or in-person visits.

Steps to Create Your Demat Account

1. Choose a Depository Participant (DP)

A DP is a financial institution authorized to offer Demat services. Most Indian stock trading apps act as intermediaries for these services. Choose a DP that aligns with your trading goals and provides a user-friendly app interface.

2. Fill Out the Application Form

Once you’ve chosen your DP, fill out the online application. Indian stock trading apps typically offer easy navigation, ensuring you complete the form in a few minutes.

3. Submit KYC Documents

Upload scanned copies of your required documents. The app will guide you step by step in submitting identity proof, address proof, and a selfie or signature if needed.

4. Complete In-Person Verification (IPV)

Some platforms require IPV, which can be done through a short video call or selfie verification. The goal is to confirm your identity with the provided documents.

5. Sign the Agreement

Digitally sign the agreement outlining the terms and conditions. The document will cover the rights and responsibilities of both the investor and the DP.

6. Get Your Demat Account Details

After successful verification, you’ll receive your Demat account number and login credentials. This enables you to access your Indian stock trading app and begin trading.

Things to Consider Before Opening a Demat Account

Before you initiate the process, here are a few things you should keep in mind:

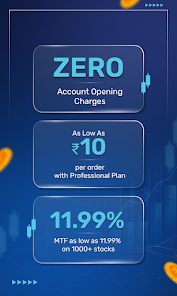

- Charges and Fees: Some accounts come with annual maintenance charges. Review the fee structure in advance.

- Trading Platform Features: Ensure the app provides essential features like live market updates, easy order placement, and portfolio tracking.

- Customer Support: A reliable support team can make a big difference, especially when you’re just starting out.

- Research Tools: Look for analytical tools and data insights that help make informed decisions.

Maintaining and Using Your Demat Account

After opening your Demat account, it’s important to maintain it properly:

- Keep your login credentials secure.

- Monitor your transactions regularly.

- Update KYC details whenever there are changes.

- Use the analysis tools available on Indian stock trading apps to track your portfolio performance.

Most trading apps offer portfolio management tools and performance trackers that help you make timely decisions. You can also schedule automatic investments in mutual funds or SIPs directly through the app.

Conclusion

Creating a Demat account no longer involves paperwork, delays, or confusion. Thanks to the rise of Indian stock trading apps, the entire process can be completed within minutes. Whether you’re a beginner aiming to explore equities or an experienced investor looking for efficiency, opening a Demat account is your gateway to the Indian stock market.

By following the steps mentioned above and choosing the right platform, you can manage your investments with confidence and ease. The Demat account is not just a regulatory requirement—it’s a practical tool that allows you to participate actively in the financial market. As you navigate the world of online investing, leveraging a reliable Indian stock trading app will enhance your experience, improve accessibility, and ensure secure asset management.

Start your journey today—create your Demat account in minutes and take your first step toward smarter investment strategies.